Unlocking the Benefits of Your Home's Equity

Some Highlights

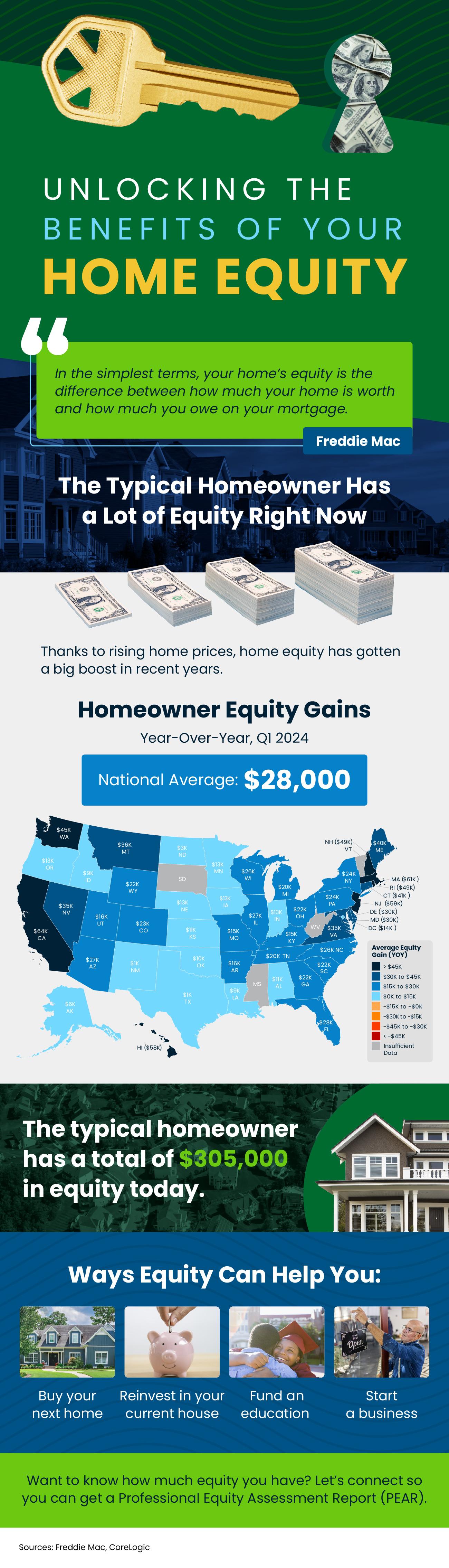

- Equity is the difference between what your house is worth and what you still owe on your mortgage.

- The typical homeowner gained $28,000 over the past year and has a grand total of $305,000 in equity. And there are a lot of great ways you can use that equity.

- To find out how much equity you have, connect with a real estate agent who can give you a Professional Equity Assessment Report (PEAR).

Recent Posts

The 3 Things You Risk by Pricing Too High

What Credit Score Do You Really Need To Buy a Home?

Home Price Forecasts for the Second Half of 2025

Today’s Tale of Two Housing Markets

Housing Market Forecasts for the Rest of 2025

The U.S. Foreclosure Map You Need To See

The Latest Mortgage Rate Forecasts

Don’t Make These Mistakes When Selling Your House

Why a Newly Built Home Might Be the Move Right Now

Mortgage Rates Are Stabilizing – How That Helps Today’s Buyers

"My job is to find and attract mastery-based agents to the office, protect the culture, and make sure everyone is happy! "

4016 Grand Ave Suite A # 1082, Chino, CA, 91710, United States